Page 47 - Memoir

P. 47

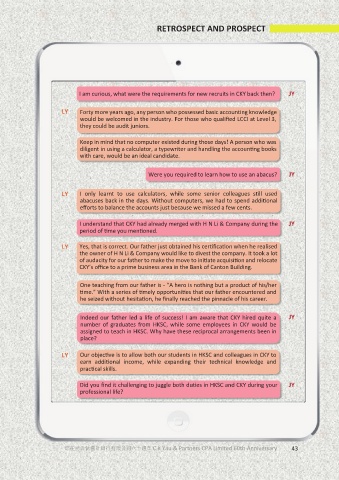

RETROSPECT AND PROSPECT

I am curious, what were the requirements for new recruits in CKY back then? JY

LY Forty more years ago, any person who possessed basic accounting knowledge

would be welcomed in the industry. For those who qualified LCCI at Level 3,

they could be audit juniors.

Keep in mind that no computer existed during those days! A person who was

diligent in using a calculator, a typewriter and handling the accounting books

with care, would be an ideal candidate.

Were you required to learn how to use an abacus? JY

LY I only learnt to use calculators, while some senior colleagues still used

abacuses back in the days. Without computers, we had to spend additional

efforts to balance the accounts just because we missed a few cents.

I understand that CKY had already merged with H N Li & Company during the JY

period of time you mentioned.

LY Yes, that is correct. Our father just obtained his certification when he realised

the owner of H N Li & Company would like to divest the company. It took a lot

of audacity for our father to make the move to initiate acquisition and relocate

CKY’s office to a prime business area in the Bank of Canton Building.

One teaching from our father is - “A hero is nothing but a product of his/her

time.” With a series of timely opportunities that our father encountered and

he seized without hesitation, he finally reached the pinnacle of his career.

Indeed our father led a life of success! I am aware that CKY hired quite a JY

number of graduates from HKSC, while some employees in CKY would be

assigned to teach in HKSC. Why have these reciprocal arrangements been in

place?

LY Our objective is to allow both our students in HKSC and colleagues in CKY to

earn additional income, while expanding their technical knowledge and

practical skills.

Did you find it challenging to juggle both duties in HKSC and CKY during your JY

professional life?

邱在光合伙會計師行有限公司六十週年 C K Yau & Partners CPA Limited 60th Anniversary 43